Posted in Architecture by Windermere Guest Author

Ipod and water bottle in hand, Dave strolls down a flower lined path toward his first destination of the morning, his gym. At the door to the gym, he is greeted by his wife, Janet. Janet takes a sip of her latte, gives Dave a kiss and tells him she’s off to the studio. While Dave is turning on some music and contemplating how many miles he’ll put on the treadmill today, Janet walks up a staircase to her studio.

Ipod and water bottle in hand, Dave strolls down a flower lined path toward his first destination of the morning, his gym. At the door to the gym, he is greeted by his wife, Janet. Janet takes a sip of her latte, gives Dave a kiss and tells him she’s off to the studio. While Dave is turning on some music and contemplating how many miles he’ll put on the treadmill today, Janet walks up a staircase to her studio.

The kiln in the corner warms the studio from the chill of the rainy night before. Janet hangs her coat and inspects yesterday’s creations on the drying rack. In her mind, she’s sizing up what glaze and design she’ll use for each piece. Dave will head to his office on the other side of the building after his workout.

Depending upon where you live, you might have your own vision of this scene. Perhaps it’s a downtown building that has ground level shops, like a gym, and small spaces upstairs for rent, like a studio. Maybe an office park in the suburbs. Perhaps even a co-op village. For Dave and Janet, though, the gym and studio are in a part of their backyard that used to be home to a jungle gym, sandbox and 4-square court. When they became empty nesters, they decided to consolidate their life, cut commuting expenses, and take advantage of some unused space at home. They created a two story, backyard cottage that had a gym, bath and shower, and kitchenette on the ground floor, as well as side-by-side offices on the upper level. Dave, rather than a kiln and pottery supplies, has a desk and display of catalogues that he will use in presentations when clients visit him.

Backyard cottages have been gaining in popularity and attention lately. With the changes in the housing market making it impractical to sell some homes, possibly gas prices making long commutes impractical, or maybe the desire to simplify a life that’s been too removed from home, its’ easy to see why someone might choose to build one. Many people build them to be guest quarters, mother-in-law apartments, a rental unit for additional monthly revenue, or temporary lodging for boomerang offspring who are trying to land that first job out of college. Some of these are as simply built as a miniature starter home, and yet others are elegantly equipped as a five-star hotel.

To maximize the value of these buildings, they should be planned by an architect so that they will work for your intended use. In the example, Janet’s kiln would be heavy and very hot, so several building precautions would be warranted. One short cut to avoid would be to do anything less than fully permitted and inspected, as failure there can cost far more than the property tax levy to take care of later. It’s advised that unless you have lots of experience, have the riskier tasks done by subcontractors.

These buildings will add value to the homeowner’s property over time, as if they are built properly, they’ll appreciate in conjunction with the value of the home. The reasons for having one are many and personal, but if you were to drive down many city streets, you will find one hiding under the trees in a corner of the backyard.

Can you see a point of your life, and a place on your property, in which a backyard cottage would make sense?

By Eric Johnson, Director of Education

By Eric Johnson, Director of Education

Johnson has several years experience as a real estate agent and real estate instructor, as well as experience in construction project management, digital media/publishing and insurance. He has a bachelor’s degree in anthropology from University of Colorado.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

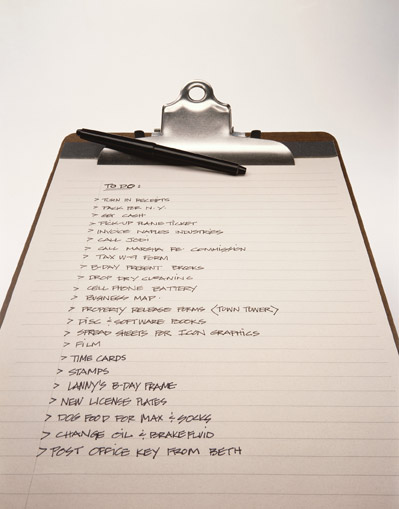

This weekend I spent the greater part of Saturday taking care of the ongoing household to do list and the transformation made a huge impact. There certainly is more to do, as is the nature of home improvement, but having a finite list of things to accomplish and making time to enjoy them made all the hard work worth it! Here is my top ten list of how to make the most of your time when tackling home-improvement projects.

This weekend I spent the greater part of Saturday taking care of the ongoing household to do list and the transformation made a huge impact. There certainly is more to do, as is the nature of home improvement, but having a finite list of things to accomplish and making time to enjoy them made all the hard work worth it! Here is my top ten list of how to make the most of your time when tackling home-improvement projects.

What is a home if not personalized to those who share its walls? Feng Shui is intended to create a place of peace, balance and harmony for you and yours. You can achieve this type of atmosphere through the things you bring into your home and the way that you stage your environment.

What is a home if not personalized to those who share its walls? Feng Shui is intended to create a place of peace, balance and harmony for you and yours. You can achieve this type of atmosphere through the things you bring into your home and the way that you stage your environment.

When it comes time to decide if you want to downsize, there are many thoughts and emotions that go speeding through your mind. Maybe you have already decided this is your home for the rest of your life. Your home was the perfect place to meet your needs when you were in an earlier cycle of life, and will be the ideal home for all the events you see happening in your next. If you are inclined to feel that the home you currently reside in may have out-lived its purpose, you may be struggling with some of the same thoughts and emotions my husband and I had when it came to the emotional and financially sensitive decision to downsize.

When it comes time to decide if you want to downsize, there are many thoughts and emotions that go speeding through your mind. Maybe you have already decided this is your home for the rest of your life. Your home was the perfect place to meet your needs when you were in an earlier cycle of life, and will be the ideal home for all the events you see happening in your next. If you are inclined to feel that the home you currently reside in may have out-lived its purpose, you may be struggling with some of the same thoughts and emotions my husband and I had when it came to the emotional and financially sensitive decision to downsize.

On any given weekend in my house, at least a couple of hours will be spent watching the designers, craftspeople and entertainers on

On any given weekend in my house, at least a couple of hours will be spent watching the designers, craftspeople and entertainers on

The financial analysis is probably the easiest of the three to assess. You will need to assess if you can

The financial analysis is probably the easiest of the three to assess. You will need to assess if you can

Recently, news about how to purchase a real-estate owned (REO/bank owned) home, foreclosure property or short sale is everywhere. Bank owned homes are sold directly from the lender after the foreclosure process is complete, and while you may save quite a bit of money by choosing to go for this type of home, it is not without trials and tribulations. The process of purchasing a home directly from a lender can be long and arduous, but could very well be worth it in the end.

Recently, news about how to purchase a real-estate owned (REO/bank owned) home, foreclosure property or short sale is everywhere. Bank owned homes are sold directly from the lender after the foreclosure process is complete, and while you may save quite a bit of money by choosing to go for this type of home, it is not without trials and tribulations. The process of purchasing a home directly from a lender can be long and arduous, but could very well be worth it in the end.

As the old saying goes, you only have one chance to make a first impression. If you’re selling your home, it’s true, except that there are several impressions to be made, and each one might have its own effect on the unique tastes of a prospective buyer. I’ve worked with scores of buyers, witnessed hundreds of showings, and I can summarize that experience down this: a tidy and well maintained home, priced right, listed with professional photographs, enhanced curb appeal and onsite visual appeal will sell fastest. We all know first impressions are very important, but the lasting impressions are the ones that sell your home. It’s not easy, but if you can detach a little and look at your home from a buyer’s perspective, the answers to selling it quickly may become obvious to you.

As the old saying goes, you only have one chance to make a first impression. If you’re selling your home, it’s true, except that there are several impressions to be made, and each one might have its own effect on the unique tastes of a prospective buyer. I’ve worked with scores of buyers, witnessed hundreds of showings, and I can summarize that experience down this: a tidy and well maintained home, priced right, listed with professional photographs, enhanced curb appeal and onsite visual appeal will sell fastest. We all know first impressions are very important, but the lasting impressions are the ones that sell your home. It’s not easy, but if you can detach a little and look at your home from a buyer’s perspective, the answers to selling it quickly may become obvious to you.