On this week’s episode of “Mondays with Matthew,” Matthew Gardner discusses housing affordability and how he believes that despite the impact of COVID-19, affordability issues will remain and may actually get worse as we move forward.

Matthew Gardner Weekly COVID-19 Housing & Economic Update: 6/29/2020

Saving in the Laundry Room

When it comes to household expenses, staying at home has brought about savings in some areas, while increasing expenses in others. The laundry room has likely seen an uptick in usage, with its associated costs following suit. Save your energy and money by keeping these tips in mind as we continue to adapt to being home more often.

Master your machine settings

Review the owner’s manuals for your washer and dryer. There may very well be energy-saving settings you’re not using. For example, your washer’s “high-speed” or “extended wash” cycles will remove more moisture, which can help reduce drying time. A dryer’s “cool down cycle” allows clothes to finish drying using only residual heat.

Think twice before washing

Once you’re aware of the costs associated with washing and drying, and the natural resources this consumes, you may decide you don’t need to launder certain clothes as often – which can also extend the life of these garments. Some clothing, like jeans, sweatshirts, and sweatpants, can be worn a few times without a cleaning. Washing these items only when necessary will help you cut down. Another tip – keep another laundry basket in your room for those lightly worn clothes that you could wear again, so they keep separate from your clean clothes.

Use hot water only when necessary

Using warm water instead of hot can significantly cut down your washer’s energy expense. Using cold water puts less pressure on electricity grids, saving your household even more money and energy. Cold water washes are less likely to shrink or fade your clothing as well. To ensure your clothes still get clean, try using a cold-water detergent.

Right-size your loads

For both washing and drying, taking into consideration the size of your load can factor greatly into your savings. No matter the size of the load you wash, it costs the same amount to run a cycle. So instead of doing two small loads, wait until you have one large load. When drying, keep in mind that an overly full dryer will take longer to dry the clothes. A dryer with too few items inside costs more to operate.

Clean the dryer vent and filter

When the lint filter in your dryer gets clogged, airflow is reduced, and the dryer can’t operate effectively. Make a point to clean the filter after every use. If you use dryer sheets, scrub the filter every month to remove any film buildup. The venting that attaches to the back of your dryer also needs to be kept clean and clear.

Air dry

When the weather is sunny and warm, consider putting your clothes out to hang-dry. Doing so will keep your drying expenses to a minimum. It can also be a better drying method for clothing with delicate tailoring.

With staying at home being the new status quo, taking a look at the ways our homes use energy and incur expenses is more relevant than ever. These small changes in the laundry room are just some of the minor adjustments you can make in your household during these unique times.

Matthew Gardner Weekly COVID-19 Housing & Economic Update: 6/22/2020

In this week’s episode of “Mondays with Matthew,” Windermere Chief Economist, Matthew Gardner, dives into the high-frequency data sets that he uses to help determine where the US economy is at with emerging from the impacts of COVID-19. Hint: there’s progress, but we aren’t out of the woods yet.

Matthew Gardner Weekly COVID-19 Housing & Economic Update: 6/1/2020

This week on “Mondays with Matthew”: Now that things have settled down somewhat following the initial impact of COVID-19, Matthew dives into the topic of mortgage rates. Will they go below 3%? Matthew discusses this and the factors that have formed his updated 2020 and 2021 mortgage rate forecast.

Matthew Gardner Weekly COVID-19 Housing & Economic Update: 5/18/2020

In this week’s episode of Mondays with Matthew, Windermere Chief Economist Matthew Gardner kicks off a series of episodes in which he answers questions from his followers. The first deals with how COVID-19 will impact buyer behaviors, especially in more urban markets.

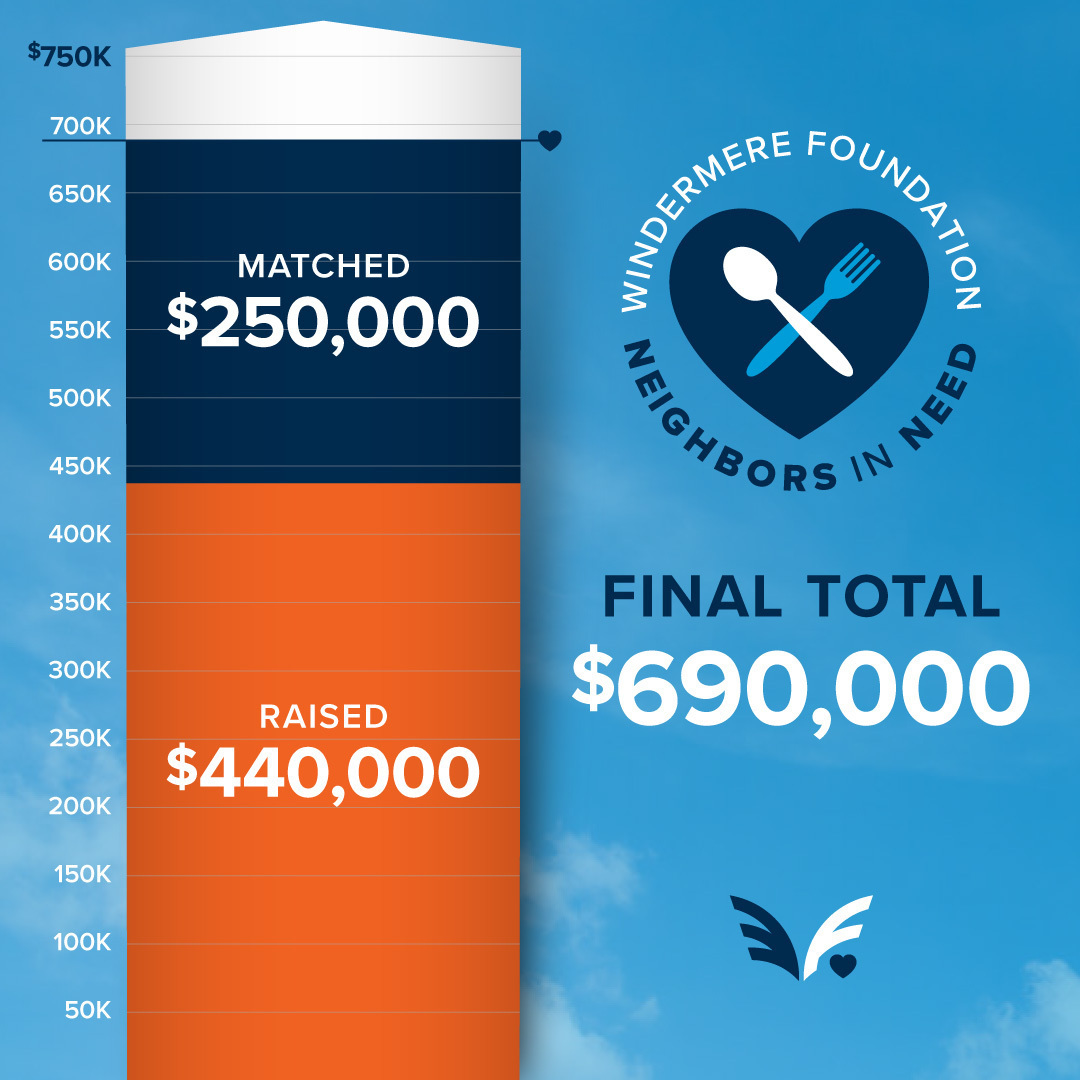

Neighbors in Need Raises $690,000 for Food Banks

The COVID-19 pandemic has affected populations across the globe, but those who struggle with poverty and count on food programs to meet their basic day-to-day needs are in an especially uncertain place. While coping with increased demand and a bottlenecked pipeline of food supply, food banks are desperate for funds to continue to serve their communities. Because of this, Windermere decided to challenge its offices to raise $250,000, every dollar of which would be matched by the Windermere Foundation and donated to food banks in the areas where Windermere operates. We titled it the “Neighbors in Need” fundraising campaign.

Neighbors in Need kicked off on April 21, with the goal of raising $250,000 by May 5. As word continued to spread, online donations and contributions from both our agents and the public began to increase. Neighbors in Need was given a boost by Seattle Seahawks starting safety Quandre Diggs in a heartfelt message encouraging support. Over the final 24 hours, leading up to the May 5 deadline, support poured in from across the Windermere family as the final figure exceeded the initial goal of $500,000, landing at a total of $690,000.

Neighbors in Need exemplifies Windermere’s deep commitment to supporting our local communities, which traces back to 1989 when the Windermere Foundation first started. Since then, we’ve proudly raised more than $41 million for low-income and homeless families throughout the Western U.S.

On behalf of the Windermere Foundation to all those who joined the effort: Thank you. We could not have made this large of an impact without your help. We are humbled to be able to do our part to help those who need it most during these uncertain times.

Follow Our Sellers Checklist To Stay Safe While Selling Your Home

Staying organized while uprooting your life and moving from one home to another can feel impossible. Not only are you trying to get the best financial return on your investment, but you might also be working on a tight deadline. There’s also the pressure to keep your home clean and organized at all times for prospective buyers. However, one thing you can be sure of when selling your home is that there will be strangers entering your space, so it’s important for you and your agent to take certain safety precautions. Like so many things in life, they can feel more manageable once written down, so we made this handy checklist.

- Go through your medicine cabinets and remove all prescription medications.

- Remove or lock up precious belongings and personal information. You will want to store your jewelry, family heirlooms, and personal/financial information in a secure location to keep them from getting misplaced or stolen.

- Remove family photos. We recommend removing your family photos during the staging process so potential buyers can see themselves living in the home. It’s also a good way to protect your privacy.

- Check your windows and doors for secure closings before and after showings. If someone is looking to get back into your home following a showing or an open house, they will look for weak locks or they might unlock a window or door.

- Consider extra security measures such as an alarm system or other monitoring tools like cameras.

- Don’t show your own home! If someone you don’t know walks up to your home asking for a showing, don’t let them in. You want to have an agent present to show your home at all times. Agents should have screening precautions to keep you and them safe from potential danger.

Talk to your agent about the following safety precautions:

- Do a walk-through with your agent to make sure you have identified everything that needs to be removed or secured, such as medications, belongings, and photos.

- Go over your agent’s screening process:

- Phone screening prior to showing the home

- Process for identifying and qualifying buyers for showings

- Their personal safety during showings and open houses

- Lockboxes to secure your keys for showings should be up to date. Electronic lockboxes actually track who has had access to your home.

- Work with your agent on an open house checklist:

- Do they collect contact information of everyone entering the home?

- Do they work with a partner to ensure their personal safety?

- Go through your home’s entrances and exits and share important household information so your agent can advise how to secure your property while it’s on the market.

Matthew Gardner Weekly COVID-19 Housing & Economic Update: 5/11/2020

Job growth is critical to the health of the housing market, so on this week’s episode of “Mondays with Matthew,” Windermere Chief Economist Matthew Gardner analyzes the effect of COVID-19 on employment and what we can expect for the duration of the year.

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

A MESSAGE FROM MATTHEW GARDNER

Needless to say, any discussion about the U.S. economy, state economy, or housing markets in the first quarter of this year is almost meaningless given events surrounding the COVID-19 virus.

Although you will see below data regarding housing activity in the region, many markets came close to halting transactions in March and many remain in some level of paralysis. As such, drawing conclusions from the data is almost a futile effort. I would say, though, it is my belief that the national and state housing markets were in good shape before the virus hit and will be in good shape again, once we come out on the other side. In a similar fashion, I anticipate the national and regional economies will start to thaw, and that many of the jobs lost will return with relative speed. Of course, all of these statements are wholly dependent on the country seeing a peak in new infections in the relatively near future. I stand by my contention that the housing market will survive the current economic crisis and it is likely we will resume a more normalized pattern of home sales in the second half of the year.

HOME SALES

- In the first quarter of 2020, 9,189 homes sold. This is an increase of 9.5% compared to the first quarter of 2019.

- Ten counties contained in this report saw sales grow, one remained static, and one saw fewer transactions. Sales rose most in the small Park County area. There was a small drop in sales in El Paso County.

- The average number of homes for sale in the quarter was down 12.9% from the same period in 2019.

- Inventory levels have not improved and, given the fallout from COVID-19, it is hard to put a date on when we will see a resumption of normal activity in the housing market. Though sales are sure to return, we may well see a gradual increase in listings rather than a surge.

HOME PRICES

Home prices continue to trend higher, with the average home price in the region rising 6.7% year-over-year to $477,495.

Home prices continue to trend higher, with the average home price in the region rising 6.7% year-over-year to $477,495.- Interest rates remain at very competitive levels and are certain to remain well below 4% for the balance of the year. This can allow prices to continue to rise but much will be dependent on the fallout of COVID-19.

- Appreciation was again strongest in Clear Creek County, where prices rose a remarkable 27.1%. This market is small though and subject to wild swings, so this jump is not surprising. We also saw strong growth in Park County, which rose 21.8%. Home prices rose by double digits in an additional three counties.

- Affordability remains an issue in many Colorado markets, which could act as a modest headwind to ongoing price growth.

DAYS ON MARKET

- The average number of days it took to sell a home in the markets contained in this report rose by only one day compared to the first quarter of 2019.

- It took an average of 46 days to sell a home in the region.

- The amount of time it took to sell a home dropped in six counties and rose in six counties compared to the first quarter of 2019.

- The Colorado housing market was performing well before the onset of the pandemic and is likely to resume reasonable performance once we resume normal operations. That said, it will be interesting to see if home sellers or buyers are the first to reengage.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given the current economic environment, I have decided to freeze the needle in place until we see

a restart in the economy. Once we have resumed “normal” economic activity, there will be a period of adjustment with regard to housing. Therefore, it is appropriate to wait until later in the year to offer my opinions about any quantitative impact the pandemic will have on the housing market.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Home prices continue to trend higher, with the average home price in the region rising 6.7% year-over-year to $477,495.

Home prices continue to trend higher, with the average home price in the region rising 6.7% year-over-year to $477,495.